cryptocurrency tax calculator uk

The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto. Youll need your transaction history in order to track your tax lots.

Calculate Your Crypto Taxes With Ease Koinly

They compute the profits losses and income from your investing activity based off this data.

. You can cash in or give away 12300 worth of gains a year tax-free but then pay 10 tax for basic ratepayers or 20 for higher ratepayers. Just by entering a few basic details on the calculator one can ascertain the short or long-term capital gains tax depending on the holding period. Crypto-currency tax calculator for UK tax rules.

UK crypto tax basics. HMRC doesnt consider cryptoassets to be a form of money whether exchange tokens utility tokens or security tokens. How to calculate your uk crypto tax calculating cryptocurrency in the uk is fairly difficult due to the unique rules around accounting for capital gains set out by the hmrc.

So is there a crypto tax in the UK. Stop worrying about record keeping filing keeping up to date with. Stay focused on markets.

CoinTrackinginfo - the most popular crypto tax calculator. That means you calculate your capital gains and if the result is below the limit you dont need to. Koinly generates a report with the income from your cryptocurrencies.

However exchange of one cryptocurrency for another will also be considered disposal. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20. Additional tax rate of 45 beyond 150000.

However when it comes to taxing them it depends on how the tokens are used. Including UK specific rules around mining staking and airdrops. Let us handle the formalities.

Although all information provided has been verified in communication with HM Revenue. You pay Capital Gains Tax when your gains from selling certain assets go over the. You pay 1286 at 20 tax rate on the remaining 6430 of your capital gains.

With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today. You pay 127 at 10 tax rate for the next 1270 of your capital gains. To calculate your capital gains as an individual the HMRC requires you to keep track of your average cost basis for the token on hand aggregate your same-day transactions and ignore any wash sales.

Capital gains tax CGT breakdown. Our platform allows you to import transactions from more than 450 exchanges and blockchains today. Income report - Mining staking etc.

Form 8949 is the tax form that is used to report the sales and disposals of capital assets including cryptocurrency. Crypto bitcoin united-kingdom tax cryptocurrency tax-calculator hmrc cryptoasset capital-gains tax-calculations cryptotax tax-reports Resources. Income from Mining Staking Forks etc has to be reported in your annual tax return.

Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. HMRC has published guidance for people who hold cryptoassets or cryptocurrency as they are also known explaining what taxes they may need to pay and what records they need to keep. Higher tax rate of 40 between 50001 to 150000.

Coinpanda is the worlds most easy-to-use cryptocurrency portfolio tracker and tax software. You have investments to make. Of course there is a wide range of tax reliefs and allowances to take advantage of so you are not hit with the full brunt of.

Online Crypto Tax Calculator with support for over 400 integrations. This includes popular cryptocurrency exchanges like Coinbase Binance FTX Uniswap and Pancakeswap. You pay no CGT on the first 12300 that you make.

12570 Personal Income Tax Allowance. For that please consult a financial adviser or tax consultant. Our Capital Gains Tax calculator gives you an estimate of how much you could have to pay in Capital Gains Tax CGT when you sell your property in the UK.

The cryptocurrency tax calculator handles this automatically using your investment and trading history. We offer full support in US UK Canada Australia and partial support for every other country. This allowance was 12500 for the 20202021 tax year.

The original software debuted in 2014. You might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. What is a Crypto Tax Calculator.

Gains and losses are calculated in your home fiat currency like the US Dollar to help you file. Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC. This site aims to provide a simple overview of UK tax rules for newcomers to bitcoin and cryptocurrency.

Under UK crypto tax rules profits on cryptocurrency disposals are considered capital gains and are accordingly subject to capital gains taxes. Beyond that level there are three tax brackets in the UK. Simply copy the numbers onto your tax return and be done in minutes.

This matters for your crypto because you subtract this amount when calculating what. The UK has some of the most comprehensive laws when it comes to cryptocurrency so its important to be aware of your tax obligations before you start trading. Since then its developers have been creating native apps for mobile devices and other upgrades.

Following the tips above will help you to minimise your. Your first 12570 of income in the UK is tax free for the 20212022 tax year. We are proud to be hosting an online seminar.

Tax on this cryptocurrency exchange in the UK will include capital gains tax. Basic tax rate of 20 between 12501 to 50000 income. A Bitcoin tax calculator is a tool that helps Bitcoin owners automate the calculator of short-term capital gains tax and the long-term capital gains tax on profit from bitcoins.

For individuals income tax supersedes capital gains tax and applies to profits. Crypto tax breaks. Additionally for each sale or exchange you will need the following information.

Whilst cryptocurrency is a relatively new asset the regulations surrounding it are still being formed. UK crypto investors can pay less tax on crypto by making the most of tax breaks. In the UK HMRC treats tax on cryptocurrency like stocks and so any realised gains are subject to Capital Gains Tax.

If activities are considered trading they will face different cryptocurrency tax in the UK. When you dispose of cryptoasset exchange tokens known as cryptocurrency you may need to pay Capital Gains Tax. Uk crypto tax calculator with support for over 100 exchanges.

From a tax perspective investing in cryptocurrency is very similar to investing in other assets like stocks bonds and real-estate. 49 for all financial years. Cryptocurrency tax calculators work by retrieving data from your exchanges wallets and other cryptocurrency platforms.

How To Calculate Cost Basis In Crypto Bitcoin Koinly

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

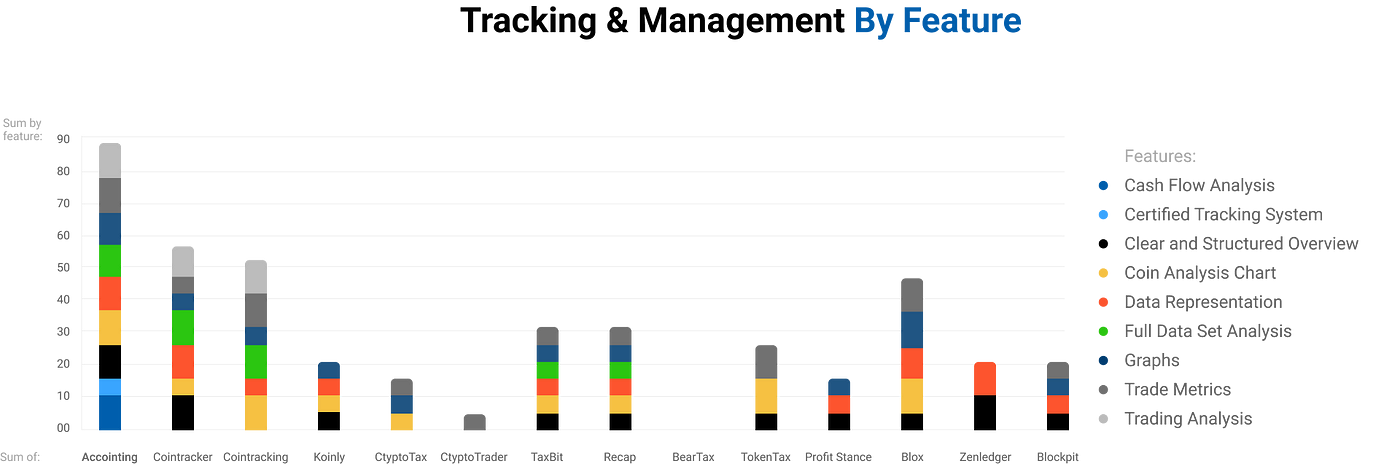

Top 8 Crypto Tax Software Alternatives To Cointracking Updated 2021 Coincodex

Crypto Taxes Hmrc Eofy Tax Deadline 31st Jan 2022 Koinly

Bitcoin Tax Calculator India Bitcoin Transaction Bitcoin Startup Company

![]()

Cointracking Crypto Tax Calculator

![]()

Cointracking Crypto Tax Calculator

5 Best Crypto Tax Software S Top Bitcoin Tax Calculator 2022 Coinmonks

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Income Tax Net Income Income

Pay Calc Uk In 2022 Finance Apps Calc Paying

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Calculate Your Crypto Taxes With Ease Koinly

Crypto Com Tax Tool Review 2022 Free Tax Calculator By Crypto Com

Uk Defi Tax On Loans Mining Staking Koinly

![]()

Cointracking Crypto Tax Calculator

5 Best Crypto Tax Software S Top Bitcoin Tax Calculator 2022 Coinmonks

Crypto Tax Calculator Review Everything You Need To Know About This Cryptocurrency Tax Software Tax Software Cryptocurrency Trading Cryptocurrency

5 Best Crypto Tax Software S Top Bitcoin Tax Calculator 2022 Coinmonks